Win Nonprofit ClientsA Guide for Investment Advisors

A hole has opened up in the maket, giving investment advisors an opportunity to win business away from the major players.

Ryan Owens

Advisors should devote more time developing nonprofit business. Competition for smaller organizations (less than $5 million investable assets) is falling. While these organizations can be slower to close, the scale with which you can deploy your efforts more than make up for longer sales cycles.

In this article, I break down why the opportunity exists, what these organizations need from an advisor, how to find them, and how to build a relationship.

In this article I discuss using our free search tools to identify nonprofits.

Before I started building software, I ran investments for nonprofit clients. It was good business. The clients were sticky, I built relationships with community leaders, and I helped some great organizations. If not for Intellispect, I would have spent my career in that role.

When managing these portfolios, I noticed a hole opening up in the market.

The Opportunity - Accounts under $5 Million in Investable Assets

The wealth management industry has been undergoing a consolidation driven by technology and fee compression for the last decade. As firms consolidate, branch offices close, employee-to-client ratios shrink, and relationship teams are forced back to headquarters.

Sending a PM and an admin 300 miles to service a $2 million portfolio is a margin killer.

So what do firms do? Small accounts get pushed to call centers. In-person meetings stop. And the relationship between advisor and organization fades away.

I ran money throughout Ohio, Kentucky, West Virginia, and North Carolina. Fly-over country. I witnessed this firsthand. I regularly heard about competitors who stopped sending teams into my territory to service accounts below $5 million.

My Coverage Territory

These accounts are forgotten business.

Fees for "forgotten business" can easily be 70 - 100bps of AUM. For advisors who can be present, forgotten business is a huge opportunity.

Small Nonprofit Investment Needs

The investment needs of large nonprofits can get complex. But small organizations are far less complicated. The primary ingredients for success are transparency and communication.

Going into a meeting with a nonprofit prospect, you should be able to discuss:

- Their Investment Policy Statement,

- Their Spending Policy,

- Expected Portfolio Return and how it relates to their Spending Policy,

- ESG strategies,

- Measuring Performance vs. a Benchmark,

- Fees (both your fee and the underlying fund fees),

- Active vs. Passive Investment Strategies and the merits of each

Of course, investments are just a piece of the relationship; they will also want to know:

- Who will serve as the primary point of contact,

- If you will be physically present for their meetings,

- How performance reviews will be structured

Far too often, organizations simply don't realize they are underserved by their current advisor. I'd see portfolios packed with proprietary funds and high rev-share tickers.

These organizations need an advisor who is upfront about fees and makes an effort to build a relationship with the leadership team.

A Strategy for Finding Opportunities at Scale

Knowing these opportunities are out there is one thing, but without a consistent stream of prospects, it won't move the needle for your practice.

Nonprofits occupy an interesting position in the world. They exist for the public's benefit. The government recognizes the good they do, and to encourage nonprofit operations, it foregoes taxing these organizations.

In exchange for tax-exempt status, the government requires that the regulatory filings of these organizations are made public. These filings contain every piece of information an advisor needs to qualify a prospect.

The 990 Filing - Tax Exempt Return

All nonprofits are required to file a 990 return with the IRS. These returns contain hundreds (sometimes thousands) of individual data points on an organization. Further, this information is freely available.

You can go to the IRS's website right now (https://apps.irs.gov/app/eos) and search for any organization's filing.

A few data points that are particularly relevant for advisors are:

- Publicly Traded Investments (Page 11 - line 11),

- Investment Management Fees (Page 10 - line 11f),

- Endowed Assets (Schedule D - Page 2 - line 1g)

Examples of Interesting Data Points

You could build a significant pipeline by scanning only these line items. The problem, of course, is time. In my old territory (OH, WV, KY, NC), there are nearly 150,000 nonprofits. I couldn't parse that many returns by hand.

Faceted Nonprofit Search

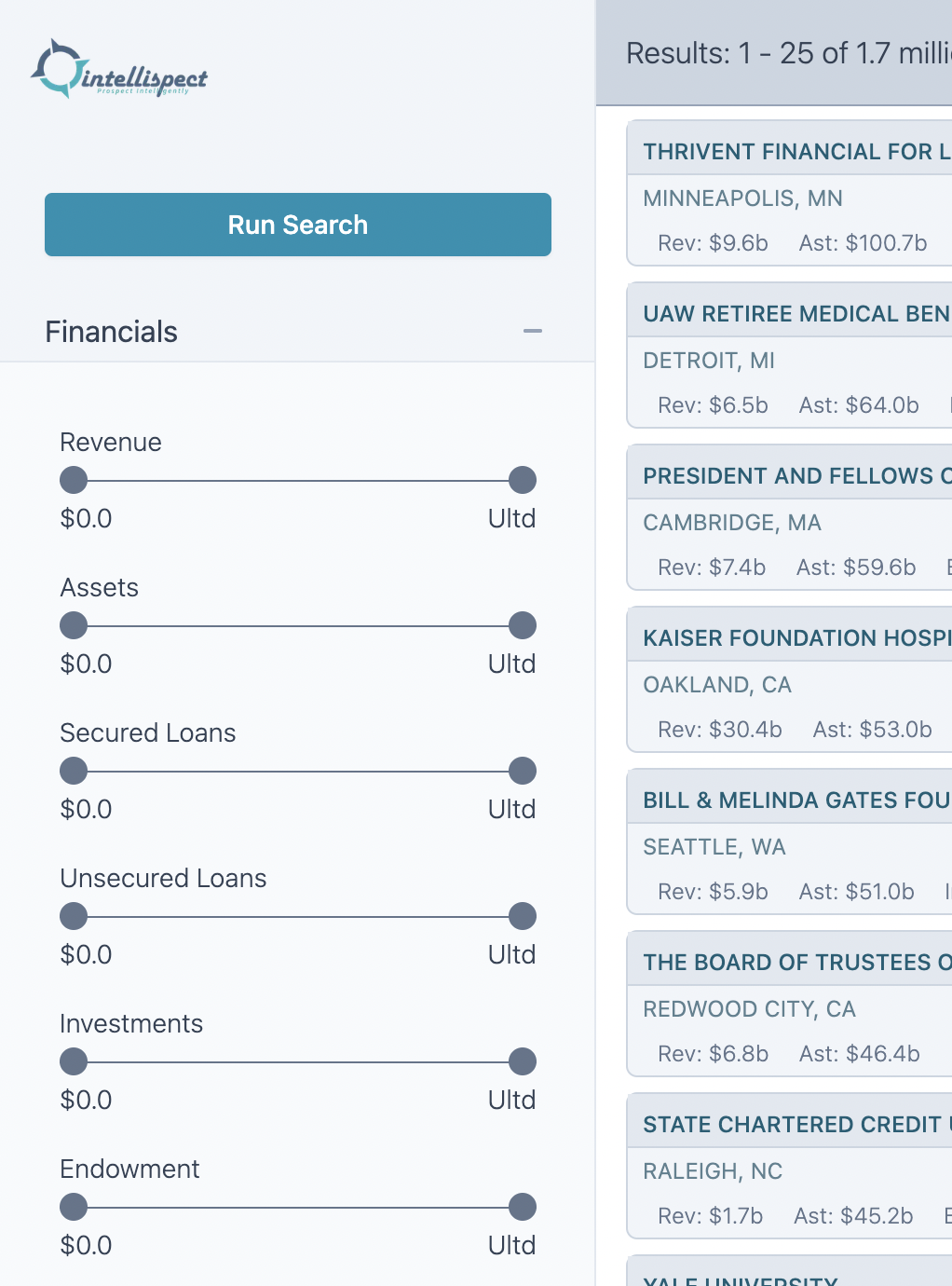

We solve nonprofit search. We download every nonprofit tax return, clean it up, store it, and make it easily searchable. You can access our search tool for free.

In a couple of seconds, you can select the states you cover along with target asset levels. This one step pared my list from 150k organizations to about 8 thousand high-quality targets. Using assets alone is a crude alternative to investable assets - but it still provides you with a much higher signal-to-noise ratio.

Turning Lists into Relationships

As with all investment management sales, converting a lead into a prospect and then a deal takes time. You need to build a relationship before you can close business.

Let's look at some strategies I have seen work in the past.

Just Introduce Yourself

Reaching out and introducing yourself can be surprisingly effective. Most nonprofits are run like businesses, and business leaders understand they need vendors for some services. Cold calling with a hard pitch will likely have a low success rate. However, stopping by and introducing yourself as someone who works in the space will probably be received just fine. You don't need to sell; just let them know who you are, and ask a question or two about their organization - Don't stay longer than 5 minutes.

The executive you speak with will know what you're doing and that the intent behind your visit is to generate business. But when you don't force them to tell you no in the first couple of interactions, it makes dealing with you much less intimidating and, eventually - even friendly.

If you meet enough Executive Directors, some will reach out to you when it's time to revisit their investment strategy.

Be an Information Source

A second approach is to be a source of information for organizations. Create a piece of content (or leverage content that your broker/dealer/bank has produced) and find organizations that would benefit from that content. Call the executive director, introduce yourself, and tell them you are sending a piece of content their way.

A couple of weeks later, follow up with another call and share a tidbit that adds to the content you sent: It could be feedback you've received or additional research you've performed, anything to get in front of them again. During the follow-up call, find a reason to invite them to coffee (or bring them coffee).

Host a Mini-Conference

A final idea is to host a mini-event for local nonprofits. Try to partner with a few local service providers (think accountants & lawyers) who work with nonprofits. Each of you put together a 30-minute presentation about something topical for the audience.

Invite decision-makers from 20-30 organizations and split the cost of the event between the hosts. For less than a thousand dollars each, you can establish yourself as an expert in your community, build a meaningful relationship with dozens of organizations and probably build a referral source from the service providers you team up with for the event.

Combine Touch Points

After a decade of working with these organizations, I found the key to winning business is staying in front of leadership teams. Don't be a salesman, be a resource. The organizations will recognize when they need help and, eventually, will think of you as the person who can help them.

With some business, this will happen quickly; with most, it will take some time. But if you do it consistently, you will reach a point where you have a continuously flowing stream of new nonprofit business opportunities.

Advanced Organization Search

If you want to take search to the next level, take a look at our Professional plans. Our pro plans allow you by criteria such as Investable Assets, Investment Manager Fees, Endowment Size, Organization's home city, and much more.

Organization Financials

Our advanced search criteria include dozens of parameters that allow you to zero in on exactly the organizations that matter for your business.

It's one of the most powerful systems available for nonprofit organization search and we're confident it will take your prospecting efforts to the next level.

If you want to learn more about our products schedule a time to chat and we can talk about my experience managing nonprofit portfolios and how to leverage the data we collect.

Pick a time that's convenient for you